China Risks Drive Taiwan’s Declining Investments

Once a mainstay of Taiwan investment, China has become increasingly unattractive to small- and medium-sized businesses that now seek to pull out completely within five years and invest elsewhere.

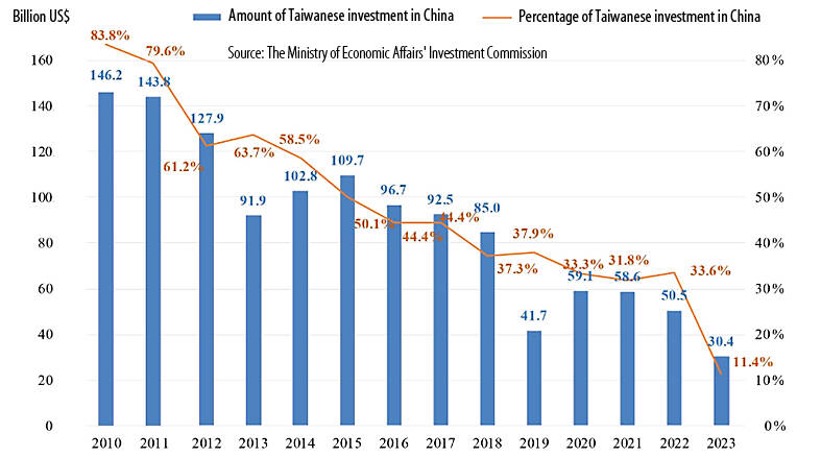

Between 1991 and 2023, China has been the destination of over 50%, or $206 billion, of Taiwan’s outbound investments. These numbers, however, mask a declining trend in Taiwan investments in China.

On 18 February Taiwan’s Mainland Affairs Council (MAC) announced that in 2023 the government had approved 328 investment projects in mainland China totaling $3.04 billion. The number of approved projects marked a decrease of 11.4% compared to 2022, and the investment amount declined 39.83% relative to 2022. Overall, Taiwan investments in China have steadily declined since 2010, when mainland China was the destination for 83.8% of Taiwan’s outbound investments.

An unnamed MAC official told Taiwan media that international and domestic Chinese factors have contributed to the decline:

- Geopolitical tensions and escalating trade disputes between China and the US have caused Taiwan businesses to direct more investments to the US, Europe, Japan, and ASEAN countries. Many are formulating plans to withdraw from China in five years.

- Taiwan businesses have soured on China’s deteriorating business risk environment, which is characterized by stagnant domestic consumption, a sluggish real estate market, a slowdown in foreign trade, and overcapacity in emerging industries such as electrical vehicles. Meanwhile, Chinese President Xi Jinping’s “Common Prosperity” policy has driven up labor costs and taxes in China.

The MAC official acknowledged that it is mostly small- and medium-sized enterprises that are planning to exit China. The scale of operation and the time required to build replacement capacity outside China make it difficult for large firms like Foxconn, Apple’s largest contract manufacturer, to transfer their operations out of mainland China.

China’s 5G influence in developing economies

China’s Belt and Road Initiative and its digital counterpart, the Digital Silk Road, threaten to displace US telecom and tech companies in developing economies in Africa, Latin America and the Middle East. How can US operators and network providers stand up to the challenge?