China Accelerates Space Dominance Pursuit

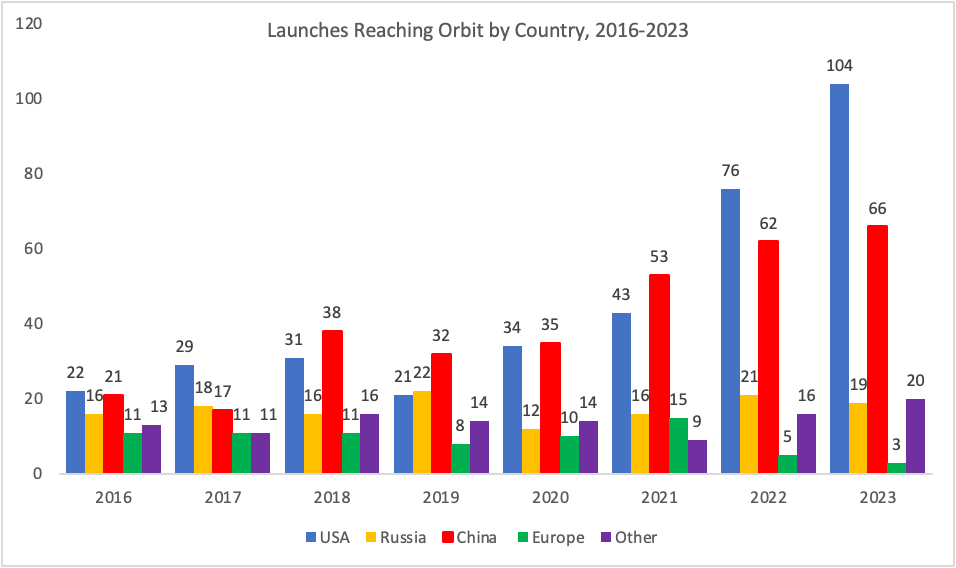

In 2023 China completed 66 launches, second only to the United States with 104 launches. Source: https://planet4589.org/space/papers/space23.pdf

2024 is poised to be a pivotal year for China's space endeavors. A notable milestone will be the Chang'e 6 lunar mission to mark China's second attempt at returning lunar surface samples to Earth following the success of the Chang’e 5 mission in 2023. The China National Space Administration also plans four manned missions that will transport taikonauts to the Tiangong space station and numerous unmanned launches that aim to enhance China's capabilities in space-based communications networks, research satellites, and Earth observation satellites.

Activities in the commercial sector are expected to continue expanding as well; Chinese commercial aerospace companies now number more than 400. The inauguration of the Hainan Commercial Space Launch site in Wenchang at the end of 2023 is set to provide additional ground infrastructure and capacity for China's private launch companies.

- On 10 January the privately funded remote sensing firm Chang Guang Satellite Technology completed a laser transmission of video data between two orbiting satellites. Last June Chang Guang set a Chinese satellite launch record by sending 41 satellites into orbit with one rocket.

While these companies fall well behind the launch frequency and capabilities of SpaceX, Blue Origin, and Virgin Galactic, 2024 is expected to be a landmark year, particularly as several have achieved significant milestones in launching privately developed rockets. Privately funded Oreinspace conducted a successful maiden flight in January. Additionally, Galactic Energy, Space Pioneer, and Rocket Pi have launches scheduled later in 2024. Their potential to compete on an international level, however, remains an open question.

Chinese experts have touted China’s aerospace industry achievements in 2023:

International aerospace partnerships. In 2023 China signed more than 150 aerospace cooperation agreements with over 50 countries and international organizations.

- In June, China completed a satellite assembly and testing center in Egypt, the first of its kind in Africa.

- On 4 December China launched the Egypt-2 remote sensing satellite into orbit.

- Belarus, Pakistan, South Africa, Egypt, and the UAE joined the International Lunar Research Station (ILRS), a project initiated jointly by China and Russia. Completion of the ILRS is expected to take place between 2035 and 2040.

Reusable space plane. On 14 December the unmanned and secretive Shenlong space plane, similar to the Boeing X-37B, was relaunched and remains in orbit. On 19 December international media reported that Shenlong deployed six unknown objects. Shenlong had completed its second flight on 8 May 2023 after 276 days in space.

Satellites. China continued the construction of an Internet mega constellation. In 2021 China initiated its Starlink-equivalent program, Guowang, and in 2023 conducted four Guowang satellite launches. Guowang is expected to eventually involve 12,992 satellites, 10% of which China plans to build by 2025.

Space station. In the process of making two manned and one cargo flight to service its space station, China achieved two key breakthroughs: in-space refueling to enable the station to maintain long-term orbital stability, and 100% oxygen regeneration inside the station.

Rocket technology improvements. China increased the payload capacity of its unmanned Tianzhou cargo spacecraft, used for resupplying China’s space station, from 6.9 tons to 7.4 tons. Six new solid-fuel rockets were developed, and the development of solid-fuel rockets ranging from 500 tons to 1,500 tons is underway.

- China completed six tests for a 700-ton rocket engine to support the development of China’s manned lunar lander, as well as two reusable rocket tests.

- On 12 July the Chinese commercial aerospace company Landspace successfully launched Zhuque-2, the world’s first methane-fueled rocket.

China’s 5G influence in developing economies

China’s Belt and Road Initiative and its digital counterpart, the Digital Silk Road, threaten to displace US telecom and tech companies in developing economies in Africa, Latin America and the Middle East. How can US operators and network providers stand up to the challenge?