Executive Brief

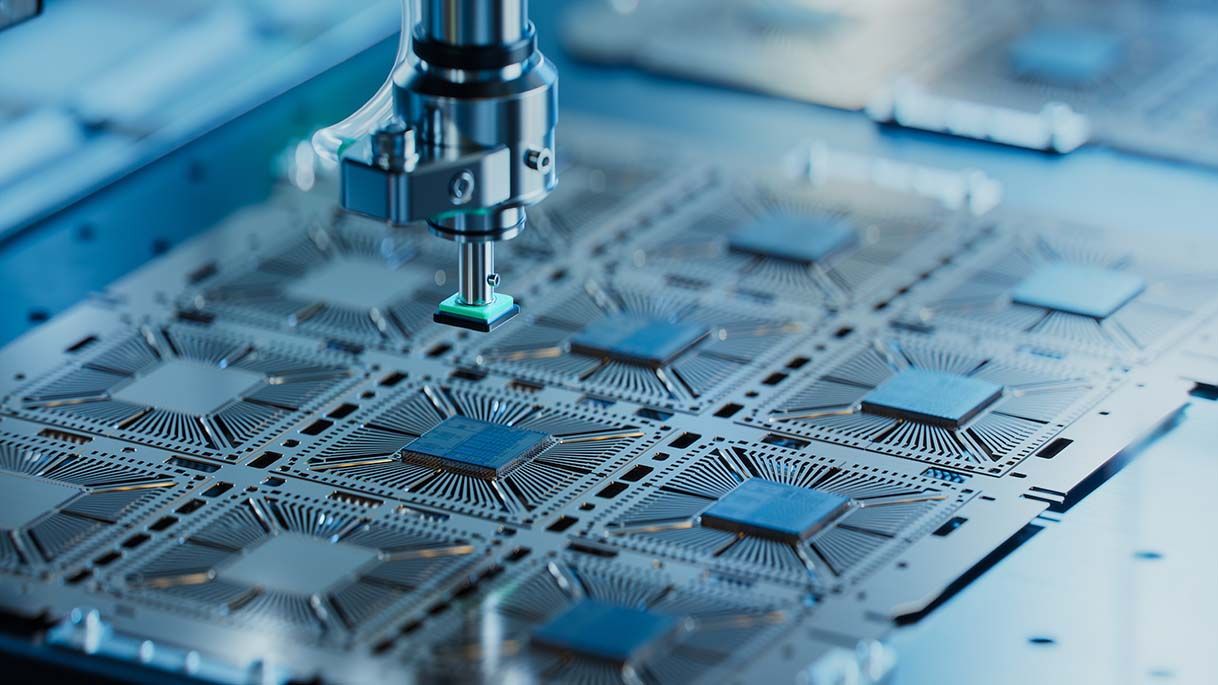

Sanctions Against Micron

On 31 March the Cyberspace Administration of China (CAC) announced a “security investigation into Micron products sold in China.” Micron, a US computer memory drive manufacturer, has been operating a plant in the central city of Xi’an since 2006 with over 3,000 employees. China was Micron’s largest market in 2018 ($17.3 billion) and became Micron’s third largest market after the US and Taiwan in 2022 (10.8% of total Micron sales at $3.3 billion).

Chinese media say Micron was targeted because Micron is a “forerunner and an activist” in the US tech war against China:

- In December 2017 Micron sued its Chinese rival—Fujian Jinhua Integrated Circuit Company—for violating its dynamic random- access memory (DRAM) patents and other intellectual property rights.

- A Chinese media report from 1 April claims that Micron delivered more than 170 anti- China reports to the US government between 2018 and 2022.

- 67% of Micron lobbying work had content targeting China.

Chinese media also allege that Micron has been actively advocating for and implementing the US CHIPS Act. In 2022 Micron announced a $15 billion investment in a new facility in Boise, Idaho; a $100 billion expansion of its facility in Clay, NY; and closure of its Shanghai DRAM design operation.

China’s Micron investigation is the first probe into a US tech company since the US-China tech war began in 2019. Brock Silvers, managing director at Kaiyuan Capital in Hong Kong stated in the South China Morning Post, “The Micron action thus represents China moving from a containment strategy to one of retaliation...the market should expect that the tech war has yet to reach its nadir.” According to the Financial Times, “Industry insiders say this is a clear signal from Beijing for its tech industry to accelerate efforts to de-Americanize its supply chains.”

China’s Micron action was also designed to send a signal to Japan, South Korea, and the Netherlands, which have coordinated their countries’ respective semiconductor export control policies to support those of the US. China’s ambassador to the Netherlands said the Netherlands’ export control “will of course negatively affect bilateral relations... China won’t just swallow this.

JapanOn 31 March Japan announced export restrictions on 23 types of semiconductor manufacturing equipment in keeping with US technology trade controls.

China claimed, “The US once brutally contained Japan’s semiconductor industry by resorting to bullying practices. Today, the US has repeated its tricks on China.” China urged Japan not to “help a villain do evil” and warned, “The blockade will only further stimulate China’s determination for independence and self-development.” Without naming China, Tokyo said it wants to stop Japan’s advanced technology from being used for military purposes: “We are fulfilling our responsibility as a technological nation to contribute to international peace and stability.”

During a visit to Beijing on 1-2 April, Japanese Foreign Minister Hayashi “strongly urged China to ensure a transparent and fair business environment and guarantee the safety and legitimate economic activities of Japanese companies.” Japan also “expressed strong concerns regarding increased attempts to force technology disclosures and transfers of technology...and strongly called for the prompt lifting of import restrictions on Japanese food products.”

- Japan also protested the recent arrest of a Japanese company executive in China on an espionage charge and demanded his “swift release.” China said the case will be “handled in accordance with the law.”

Taiwan media reported on 6 April that China was using its antitrust review process as a countermeasure to US semiconductor export controls against China. The report said Chinese authorities were holding up antitrust reviews for Intel’s $5.2 billion acquisition of Tower Semiconductor, an Israeli company, and the $3.8 billion acquisition of Silicon Motion Technology of Taiwan by MaxLinear, a US electronic company.

The acquisitions need Beijing’s approval because each of them derives more than $117 million in annual revenue from China. As a prerequisite for its approval of the acquisitions, Beijing is demanding that Intel and MaxLinear not “discriminate” against China in their global sales — this almost certainly conflicts with the requirement for US companies to comply with increasingly restrictive US semiconductor export controls.

On 12 April Intel’s CEO Pat Gelsinger met China’s Vice President Han Zheng in Beijing and discussed Intel’s relations with China.

- China additionally has not yet approved Microsoft’s $68.7 billion acquisition of online gaming company Activision Blizzard. In November 2022 DuPont terminated its $5.2 billion acquisition of Rogers Group, a US company specializing in engineered materials, due to a delayed Chinese antitrust approval.