COP29 highlights the Asia-Pacific’s need to accelerate its energy transition offering investment opportunities for foreign companies

COP29 highlighted the need to accelerate the Asia-Pacific’s transition to renewable and clean energies. As one of the world’s largest consumers of energy, much of which has been coal, the region has an important role to play in meeting global climate change targets. It therefore offers significant opportunity for investment and business operations in the clean energy sector.

The 29th Conference of the Parties (COP29) was hosted in Baku, Azerbaijan in November last year. Most of the focus was on the need to accelerate the global transition to clean energy technologies.

During the conference several energy initiatives were introduced, including the Global Energy Storage and Grid Pledge, the Green Energy Pledge, Green Energy Zones and Corridors, and the Hydrogen Declaration. Governments of developed countries also pledged $3 billion per year until 2035 (which is a tripling of the previous annual amount), with a second wider goal of $1.3 trillion to be mobilized by the same year.

The Asia-Pacific is one of the largest consumers of coal

The Asia-Pacific consumed 78% of global energy capacity in 2023, according to the Statistical Review of World Energy. The IEA estimates coal accounted for 48.9% of the region’s energy production, oil 23.3%, and natural gas 11.1%. As a result, the need to accelerate the region’s transition to cleaner energy technologies was high on the agenda.

According to the IEA, China, India, and ASEAN countries together consumed three-quarters of global demand for coal in 2022[1]. This is up from 35% of global coal usage in 2000.

The IEA also predicts that three-quarters of the increase in energy demand in the region, according to Stated Policies Scenario (STEPS), will be met by fossil fuels until 2030, leading to a near 35% increase in CO2 emissions. Energy demand, in general, has increased on average by 3% a year over the past two decades in the Asia-Pacific[2]. It means that there will be significant investment opportunities in the region to help it accelerate its transition to clean energies, such as wind (offshore and onshore) and solar.

However, the region currently receives only 2% of global clean energy investment, despite accounting for 6% of global GDP, 5% of global energy demand, and being home to 9% of the world’s population. This is leading to a rethink among the Asia-Pacific countries. Many governments across the region have announced ambitious long-term plans to reach net zero emissions and carbon neutrality targets by 2030. Hence, the need for external investment.

Significant opportunities in the Asia-Pacific’s clean energy sector

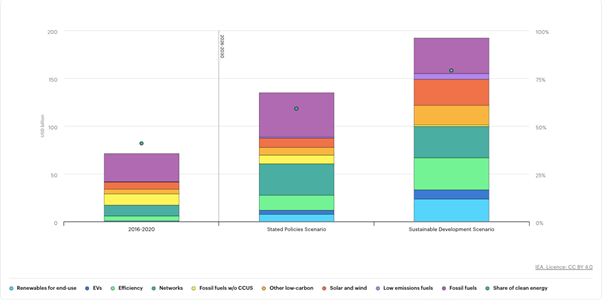

It means that the Asia-Pacific is becoming a hotbed for clean energy technology development, deployments, investment, and business opportunity. Figure 1 shows the predicted annual investment in different energy sources (see Figure 1).

Figure 1. Average annual energy investment in Southeast Asia, 2016-2030

Countries covered in the above data are:

Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam.

Source: International Energy Association

China and South Korea, for example, are significant bilateral investors in the region. Both are successfully transitioning away from fossil fuels themselves. China’s coal demand and production remain high – every one in four tons of coal used globally is used to fire China’s electricity demand (see Figure 2)[3]. However, between 2019 and 2024, China accounted for 40% of global renewable capacity expansion.

Source: PF Nexus

Regional objectives

Improved infrastructure, and government subsidies have made China one of the leading users and manufacturers of solar photovoltaic and wind energy (China generated 37% of global wind and solar electricity in 2023 – enough to power Japan). The IEA’s Net Zero Emissions scenario sets out a global target of 40% of electricity generation from solar and wind by 2030 – it estimates that China could reach 30% by 2030.

Singapore is another major investor in clean energy in the Asia-Pacific, pledging $500 million to support Financing Asia’s Transition Partnership, launched by Monetary Authority of Singapore in 2023, at COP29. Pamir LLC can consult on opportunities for US companies in the region.

The Asia-Pacific harnesses offshore wind power

The region is also looking to expand its offshore wind capacity, which could see these capabilities grow four-fold by 2030, according to Wood Mackenzie.

South Korea is investing heavily in offshore wind power, after Seoul passed the Offshore Wind Power Competitive Bidding Roadmap in August 2024. In November, Beijing announced plans to build a $26.5 billion floating wind farm off the coast near Ulsan City – it would be the largest of its kind globally. The project will mainly be European funded.

Indonesia’s new government also promised that it would continue to support its ambitious transition goals to build 100GW of new energy capacity, of which 75% would come from renewable sources.

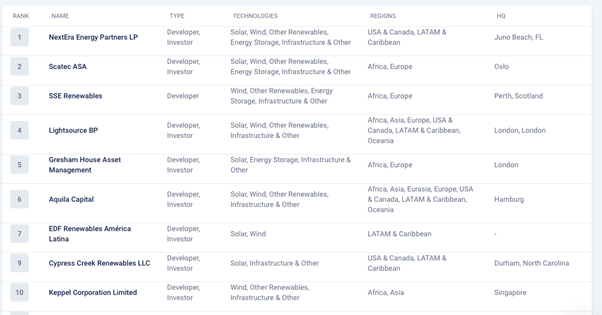

While China has pressed ahead with its clean energy strategy – as shown in Figure 2, there are still opportunities for Western companies[4]. It highlights the top 10 clean energy investors in the region, according to PF Nexus (although it doesn’t break out any figures), and includes hundreds more.

Figure 2. Top 10 Western company investors in the Asia-Pacific’s clean energy transition.

Nuclear Power and Hydrogen Declarations

Nuclear power expansion was also heavily supported at COP29, during which many countries further endorsed a Declaration to Triple Nuclear Energy – it is also already supported by 25 countries across 4 continents. The U.S. is particularly keen and announced plans to deploy 200GW of new nuclear capacity by 2050, tripling its existing capabilities. Initial plans aim for an additional 35GW by 2035.

Hydrogen energy production was also high on the agenda at COP29. The Hydrogen Declaration is supported by national governments and other stakeholders that have committed to work together to scale up the production and deployment of hydrogen capacity and infrastructure. Its use was highlighted as having particular potential in ‘hard-to-decarbonize’ applications, such as heavy industry and transportation.

COP29 highlighted the challenges faced by the Asia-Pacific in its transition to renewable energies However, it offers significant potential for investment and operation in the region. Pamir has decades of experience of working for U.S. organizations looking to tap into this huge and lucrative market.

Our unique blend of quantitative and qualitative research, on-the-ground networking with regional influencers, and our end-to-end risk assessment service has helped many companies to enter the the Asia-Pacific market, minimizing risk and maximizing opportunity.

Contact us today to find out how we can help you find clean energy investment opportunities in the Asia-Pacific.

[1] https://iea.blob.core.windows.net/assets/a72a7ffa-c5f2-4ed8-a2bf-eb035931d95c/Coal_2023.pdf

[2] https://www.iea.org/reports/southeast-asia-energy-outlook-2022/key-findings#

China’s 5G influence in developing economies

China’s Belt and Road Initiative and its digital counterpart, the Digital Silk Road, threaten to displace US telecom and tech companies in developing economies in Africa, Latin America and the Middle East. How can US operators and network providers stand up to the challenge?