China claims progress in advanced chips as it seeks workarounds to export bans

China’s largest chip maker will start mass producing 5-nanometer chips for Huawei this year — and is also working on developing ‘chiplets’ as it seeks to become self-reliant in response to US export bans.

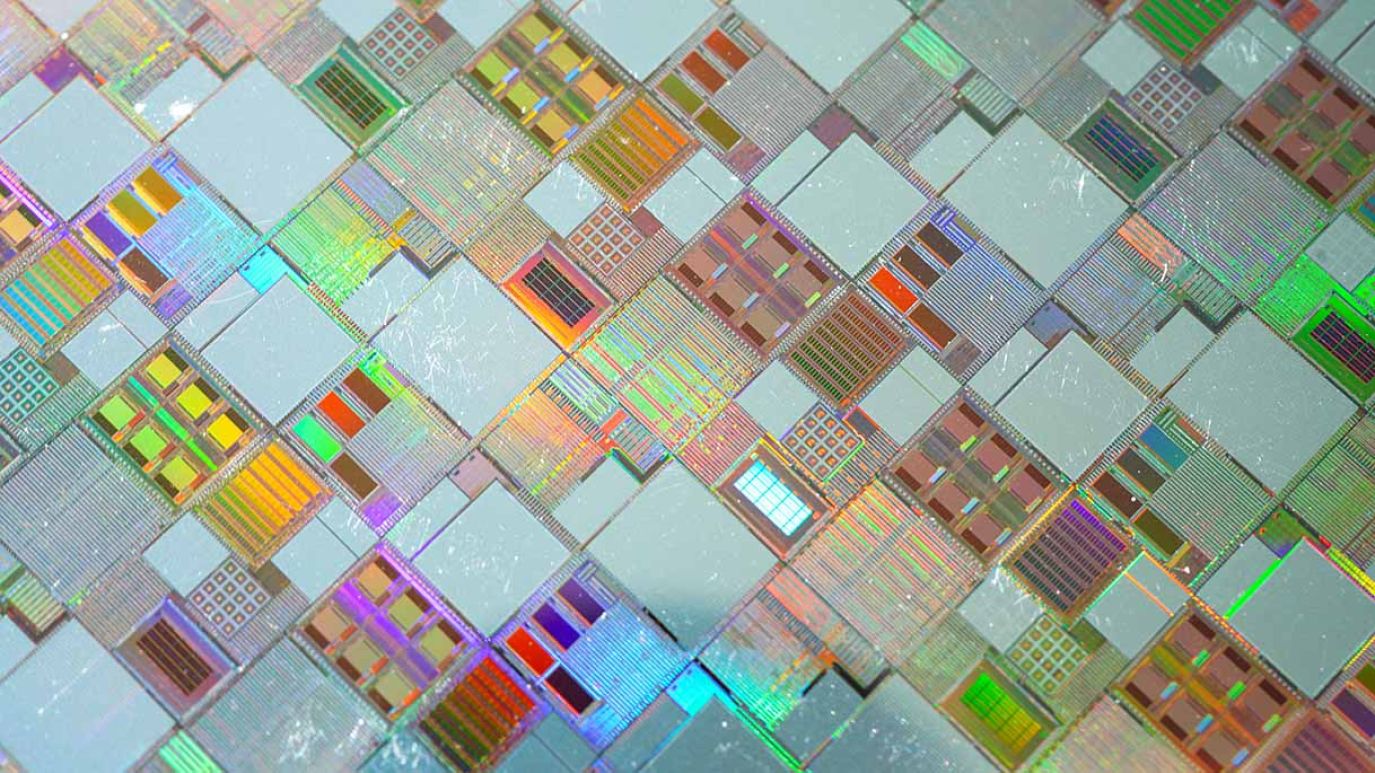

China’s largest chip maker, Semiconductor Manufacturing International Corp (SMIC), has announced that it will start mass producing 5-nanometer chips for Huawei in 2024, as the former pushes forward with building new semiconductor production fabs in Shanghai.

While the yield is low (estimated at 30-40%) and production costs are high for these chips, it’s a determined message from China that it intends to circumvent bans on the export of advanced chips from the West and its allies by becoming self-reliant. In that sense, it is considered more of a political show than a financially feasible one.

TSMC, Apple, and Samsung still lead the way with 3nm chips

The world’s first 3nm chip was announced on 7 September 2023 by MediaTek and Taiwan Semiconductor Manufacturing Company (TSMC) with volume production expected in 2024. In the same month, Apple announced that the iPhone 15 Pro and iPhone 15 Pro Max would feature a 3nm chip, called the A17 Pro. In January, meanwhile, Samsung announced that it is now producing a trial version of a second-generation 3nm process chip, the SF3, and is expecting yield rates of over 60% within the next six months.

Having said that, Huawei still surprised Washington last August when it launched the Kirin 9000s chip in its Mate60 Pro phone, which was made by SMIC using an N+2 process via DUV lithography. Then, in December, Huawei unveiled the Qingyun L540 laptop that uses a Kirin chip called 9006C, which is viewed as a technological breakthrough for Huawei.

However, it’s believed that 9006C chips came from inventory delivered before TSMC was banned by the US in mid-September 2020. While SMIC might be able to make 7nm chips with a yield of 50%, and 5nm chips with a yield of 30-40%, its pricing is said to be more than 50% above TSMC. Its yield for 7nm chips is currently estimated at much lower – around one-third that achieved by TSMC.

SMIC plans to increase production of 7nm and 5nm chips for Huawei

In terms of SMIC’s latest plans, it’s aiming to use its existing stock of US and Dutch-made equipment to produce more-miniaturized 5-nanometer chips. At the same time, SMIC has increased production capacity for Huawei’s 7nm Ascend 910b chip, which is considered by industry experts to be one of the most promising alternatives available to Nvidia’s advanced AI-based processors.

The production line is also expected to make Huawei’s HiSilicon 5nm Kirin chips for new Huawei smartphones, showing that Beijing is making some progress in developing advanced chips despite export bans on chips and chip-making equipment from the US and Netherlands, respectively.

Dutch company ASML Holdings is arguably the most important chip manufacturing equipment company in the world as it developed extreme ultraviolet (EUV) lithography tools – a highly advanced way to etch integrated circuits onto silicon wafers. No other global equipment maker has this technology, and it has never been made available to Chinese chip manufacturers.

On 30 June 2023, after pressure from Washington, ASML also announced export restrictions (aimed at China, but not made explicit) on deep ultraviolet lithography (DUV) systems – a less advanced system for etching chips than EUV, but still essential.

Chinese chip engineers are said to be using DUV lithography to produce 5nm chips, but the cost can high and the yield low as it requires a four-pass patterning technique requiring multiple exposures and etching processes, which makes it prone to inaccuracies.

China looks to chiplets for advanced systems

In another attempt to become self-reliant in chip manufacturing and work around export bans, the Chinese government and venture capitalists have focused on building China’s ‘chiplet’ sector. Unlike traditional systems-on-a-chip, which integrate all components onto a single chip, chiplets offer a modular approach whereby each chiplet has a dedicated function and are then connected to create a complex, advanced system.

The advantage is that each function, or chiplet, can be swapped out and upgraded as technology advances. It also offers a workaround for Beijing when it comes to creating advanced chips. Chiplets were included in MIT’s Technology Review as one of the top 10 breakthrough technologies of 2024 and have already been used by companies such as AMD, Intel, and Apple in their products.

Despite the export bans placed on Beijing, when it comes to advanced chips and the required equipment to make them it seems that China is making progress and within a few years may catch up. Although the industry hopes that the US will focus on maintaining its dominance and innovation in chip design, China will continue to seek ways to thwart export bans, to include its unrelenting efforts to acquire foreign technology through technical means and insider sources.

China’s 5G influence in developing economies

China’s Belt and Road Initiative and its digital counterpart, the Digital Silk Road, threaten to displace US telecom and tech companies in developing economies in Africa, Latin America and the Middle East. How can US operators and network providers stand up to the challenge?