-

Blog

Asia is set to power the global semiconductor market for the foreseeable future

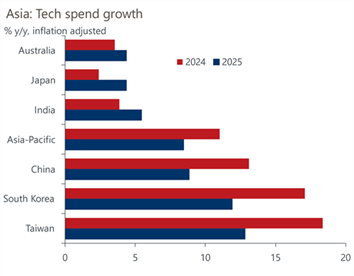

According to a recent report from Oxford Economics, the Asia Pacific is set to be the fastest growing market for global technology spend in 2025, at 7.6%[1]. While this will slow from 2024’s predicted 10.2% growth in the region, this year’s projected growth will still outpace Europe (4.3%) and the Americas (5.1%). The report also notes that much of this growth in the Asia Pacific will be led by the semiconductor industry.

Asia will see most growth in tech spend in 2024 due to chip demand

The fastest-growing economies in the region, in terms of US dollars spend, will be Taiwan, South Korea, and China. Figure 1 shows predicted technology expenditures in the region, by country. As illustrated, the economies that are predicted to see the largest growth in technology expenditures in 2024 are Taiwan (13.2%), South Korea (10%), and China (6.1%), and the main reason for this is demand for semiconductors.

Figure 1. Asia technology spend by economy, 2024 and 2025.

Source: Oxford Economics

It notes that expenditures in Australia, Japan, and India reflect final demand, and growths in these countries are largely driven by spending on communication, IT services, internet, and cloud computing. However, the report also points out that demand for AI processing power and applications is set to drive the chip market for some years.

TSMC predicts "extremely robust" demand for AI chips

It follows a recent interview, published on October 17, 2024, by Nikkei Asia magazine, with C.C. Wei, the CEO and chairman of Taiwan Manufacturing Semiconductor Company (TSMC), who said that "extremely robust" demand for AI processing power will drive semiconductor sales for years and deliver another record-breaking quarter for the world's largest contract chipmaker.[2]

According to Statista, in the first quarter of 2024, TSMC held a 61.7% market share in the global semiconductor foundry market.[3] The company also has plans to expand globally. In August 2024, TSMC started the first phase of construction on its €10 billion semiconductor fabrication plant in Dresden, Germany. The plant, called the European Semiconductor Manufacturing Company (ESMC), is a joint venture between Infineon, NXP, and Bosch, with each holding a 10% stake. Production is expected to start in 2027 and reach full capacity by 2029.

In April 2024, TSMC also announced plans for its third $6.6 billion fabrication plant in Arizona, U.S., with direct funding coming from the U.S. CHIPS and Science Act. Prior to that the company had already invested $65 billion in two plants in the state. TSMC (rather, its joint venture Japan Advanced Semiconductor Manufacturing) also announced the opening of its first plant in Kumamoto, Japan, in February 2024. It further announced a second fab plant in Japan, bringing its investment in the country to more than $20 billion, with the support of the Japanese government.

The new fab is expected to have a total monthly capacity of more than 100,000 12-inch wafers designed for applications such as automotive, industrial, consumer, and high-performance computing applications (i.e., AI).

TSMC manufactures AI chips designed by U.S. companies Nvidia and Advanced Micro Devices. The chip manufacturer reported that its AI revenue more than tripled in 2024.

Taiwan leads the way in chip market share, but other economies in the region are growing fast

While Taiwan leads the global growth in advanced semiconductors, which is being driven by the demand for AI, Japan has plans to become integral to the global supply chain for the new generation of advanced chips, building on its existing strengths. Its government is investing heavily in R&D and subsidizing domestic and foreign companies. In September 2024, for example, Canon shipped its latest lithography system for chip manufacturing to a Texas-based semiconductor consortium.

Likewise, South Korea is a semiconductor powerhouse, accounting for 17.9% of the world’s total semiconductor production capacity. Other Asia-Pacific countries are also global leaders in the semiconductor industry. For example, Malaysia is the world’s sixth-largest exporter of semiconductors (13%), although mostly in less advanced chips. In September, Thailand announced a $345 million project to build the country's first front-end fab, which could come online as early as 2027. The Asia Pacific region looks set to drive chip manufacturing for some years to come.

[1] https://www.oxfordeconomics.com/resource/asia-pacific-region-enterprise-tech-spending-led-by-semiconductor-players/

[2] https://asia.nikkei.com/Business/Tech/Semiconductors/TSMC-says-insane-AI-demand-is-real-and-a-boon-for-chip-giant

[3] https://www.statista.com/statistics/867223/worldwide-semiconductor-foundries-by-market-share/

China’s 5G influence in developing economies

China’s Belt and Road Initiative and its digital counterpart, the Digital Silk Road, threaten to displace US telecom and tech companies in developing economies in Africa, Latin America and the Middle East. How can US operators and network providers stand up to the challenge?